CBSE Class 12 Accountancy – MCQ and Online Tests – Unit 10 – Accounting Ratios

Every year CBSE conducts board exams for 12th standard. These exams are very competitive to all the students. So our website provides online tests for all the 12th subjects. These tests are also very effective and useful for those who preparing for competitive exams like NEET, JEE, CA etc. It can boost their preparation level and confidence level by attempting these chapter wise online tests.

These online tests are based on latest CBSE Class 12 syllabus. While attempting these our students can identify the weak lessons and continuously practice those lessons for attaining high marks. It also helps to revise the NCERT textbooks thoroughly.

CBSE Class 12 Accountancy – MCQ and Online Tests – Unit 10 – Accounting Ratios

Question 1.

The gross profit ratio is the ratio of gross profit to :

(a) Net Cash Sales

(b) Net Credit Sales

(c) Closing Stock

(d) Net Total Sales

Answer

Answer: (d) Net Total Sales

Question 2.

Which one of the following ratios is most important in determining the long-term solvency of a company ?

(a) Profitability Ratio

(b) Debt-Equity Ratio

(c) Stock Turnover Ratio

(d) Current Ratio

Answer

Answer: (b) Debt-Equity Ratio

Question 3.

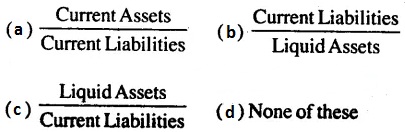

Liquidity Ratio:

Answer

Answer: (c)

Question 4.

The ratios are primarily measures of earning capacity of the business.

(a) Liquidity

(b) Activity

(c) Debt

(d) Profitability

Answer

Answer: (d) Profitability

Question 5.

Total Assets ₹ 8,10,000

Total Liabilities ₹ 2,60,000

Current Liabilities ₹ 40,000

Debt-equity ratio is:

(a) 0.05 : 1

(b) 0.4 : 1

(c) 2.5 : 1

(d) 4 : 1

Answer

Answer: (c) 2.5 : 1

Question 6.

Total Assets ₹ 7,70,000

Total Liabilities ₹ 2,60,000

Current Liabilities ₹ 40,000

Total Assets to Debt Ratio is:

(a) 3.5 : 1

(b) 2.56 : 1

(c) 2.8 : 1

(d) 3 : 1

Answer

Answer: (a) 3.5 : 1

Question 7.

Operating Ratio is:

(a) Profitability Ratio

(b) Activity Ratio

(c) Solvency Ratio

(d) None of these

Answer

Answer: (a) Profitability Ratio

Question 8.

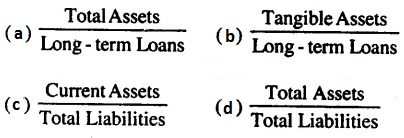

The formula for ascertaining Total Assets to Debt Ratio is:

Answer

Answer: (a)

Question 9.

Which of the following is an operating’ income ?

(a) Sale of Merchandise

(b) Interest Income

(c) Dividend Income

(d) Profit on the sale of old car

Answer

Answer: (a) Sale of Merchandise

Question 10.

Which of the following non-operating expense?

(a) Rent

(b) Selling Expenses

(c) Wages

(d) Loss on Sale of Machinery

Answer

Answer: (d) Loss on Sale of Machinery

Question 11.

Current Ratio includes:

(a) Stock

(b) Debtors

(c) Cash

(d) All of these

Answer

Answer: (c) Cash

Question 12.

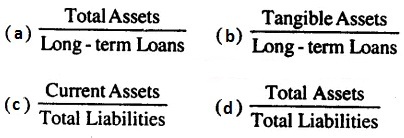

Proprietory ratio is calculated by the following formula:

Answer

Answer: (c)

Question 13.

The following groups of ratios primarily measure risk

(a) Liquidity, activity and profitability

(b) Liquidity, activity and common stock

(c) Liquidity, activity and debt

(d) Activity, debt and profitability

Answer

Answer: (d) Activity, debt and profitability

Question 14.

To know the return on investment, by capital employed we mean:

(a) Net Fixed Assets

(b) Current Asset-Current Liabilities

(c) Gross Block

(d) Fixed Assets + Current Assets-Current Liabilities

Answer

Answer: (d) Fixed Assets + Current Assets-Current Liabilities

Question 15.

The term fixed assets include :

(a) Cash

(b) Machinery

(c) Debtors

(d) Prepaid Expenses

Answer

Answer: (b) Machinery

Question 16.

If sales is 7 4,20,000 sales returns is 7 20,000 and cost of goods sold 7 3,20,000 gross profit ratio will be :

(a) 20%

(b) 25%

(c) 15%

(d) 10%

Answer

Answer: (a) 20%

Question 17.

Ratio based on figures of profit & loss as well a the Balance sheet are:

(a) Profitability Ratios

(b) Operation Ratio

(c) Liquidity Ratio

(d) Composite Ratio

Answer

Answer: (d) Composite Ratio

Question 18.

Equity share capital ₹ 15,00,000

Reserve and Surplus ₹ 7,50,000

Total Assets ₹ 45,00,000

Properletory Ratio ?

(a) 50%

(b) 33.3%

(c) 200%

(d) 60%

Answer

Answer: (a) 50%

Question 19.

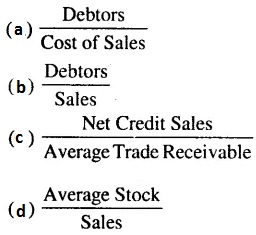

Debtors Turnover Ratio :

Answer

Answer: (c)

Question 20.

When opening stock is ₹ 50,000 closing stock ₹ 60,000 and cost of goods sold is ₹ 2,20,000, then stock turn over ratio is:

(a) 2 times

(b) 3 times

(c) 4 times

(d) 5 times

Answer

Answer: (a) 2 times

Question 21.

What does Creditors Turnover Ratio take into account:

(a) Total credit purchases

(b) Total credit sales

(c) Total cash sales

(d) Total cash purchases

Answer

Answer: (a) Total credit purchases

Question 22.

Cost of goods sold :

(a) Sales – Net profit

(b) Sales – Gross profit

(c) Purchases – Opening Stock

(d) None of the above

Answer

Answer: (b) Sales – Gross profit

Question 23.

Proprietory Ratio indicates the relationship between proprietor’s funds and….

(a) Reserve

(b) Share Capital

(c) Total Assets

(d) Debentures

Answer

Answer: (c) Total Assets

Question 24.

The term‘Current Assets’include

(a) Long-term Investment

(b) Short-term Investment

(c) Furniture

(d) Preliminary Expenses

Answer

Answer: (b) Short-term Investment

Question 25.

The ideal liquid ratio is :

(a) 2 : 1

(b) 1 : 1

(c) 5 : 1

(d) 4 : 1

Answer

Answer: (b) 1 : 1

Question 26.

Profitability Ratios are generally expressed in :

(a) Simple Ratio

(b) Percentage

(c) Times

(d) None of these

Answer

Answer: (b) Percentage

Question 27.

Operating Ratio is:

(a) Profitability Ratio

(b) Activity Ratio

(c) Solvency Ratio

(d) None of these

Answer

Answer: (a) Profitability Ratio

Question 28.

Stock turnover ratio comes under :

(a) Liquidity Ratio

(b) Profitability Ratio

(c) Activity Ratio

(d) None of these

Answer

Answer: (c) Activity Ratio

Question 29.

The satisfactory ratio between internal and external equity is. :

(a) 1 : 2

(b) 2 : 1

(c) 3 : 1

(d) 4 : 1

Answer

Answer: (b) 2 : 1

Question 30.

Current Ratio =

(a) Current Assets/Current Liabilities

(b) Liquid Assets/Current Liabilities

(c) Liquid Assets/Current Assets

(d) Fixed Assets/Current Assets

Answer

Answer: (a) Current Assets/Current Liabilities

Question 31.

Liquid Assets include :

(a) Bills Receivable

(b) Debtors

(c) Cash Balance

(d) All of these

Answer

Answer: (d) All of these

Question 32.

The ideal current ratio is :

(a) 2 : 1

(b) 1 : 2

(c) 3 : 2

(d) 3 : 4

Answer

Answer: (a) 2 : 1

Question 33.

Which of the following assets is not taken into consideration in calculating acid-test ratio ?

(a) Cash

(b) Bills Receivable

(c) Stock

(d) None of these

Answer

Answer: (c) Stock

Question 34.

The two basic measures of liquidity are :

(a) Inventory Turnover and Current Ratio

(b) Current Ratio and Liquid Ratio

(c) Current Ratio and Average Collection Period

(d) Current Ratio and Debtors Turnover Ratio

Answer

Answer: (b) Current Ratio and Liquid Ratio

Question 35.

Liquid Ratio is also known as:

(a) Current Ratio

(b) Quick Ratio

(c) Capital Ratio

(d) None of these

Answer

Answer: (b) Quick Ratio

Question 36.

To test the liquidity of a concern which of the following ratios is useful ?

(a) Capital Turnover Ratio

(b) Acid Test Ratio

(c) Stock Turnover Ratio

(d) Net Profit Ratio

Answer

Answer: (b) Acid Test Ratio

Question 37.

Profitability Ratio is generally shown in :

(a) Simple Ratio

(b) Percentage

(c) Times

(d) None of these

Answer

Answer: (b) Percentage

Question 38.

When Cash is 7 10,000 Stock is 7 25,000, B/R is 7 5,000 Creditors is 7 22,000 and Bank Overdraft is 7 8,000 then current ratio is :

(a) 2 : 1

(b) 4 : 3

(c) 3 : 4

(d) 1 : 2

Answer

Answer: (b) 4 : 3

Question 39.

The term ‘Current Liabilities’ does not include: .

(a) Sundry Creditors

(b) Debentures

(c) Bills Payable

(d) Outstanding Expenses

Answer

Answer: (b) Debentures

0 Comments:

Post a Comment